Tracking the Financial Icebergs in Australia.

In today’s post Dr. Archana Voola, Research fellow at University of New South Wales, discusses the societal, community and individual levels factors playing a role in our everyday financial lives. The daily news media depicts stories about the debt crisis, housing un-affordability and sluggish wage growth. But what is actually happening behind these numbers? Who are the humans who make up the data? And what can we do about it? Archana uses her sociological imagination to uncover the icebergs in the financial seascape of Australia.

As a new research fellow at Centre for Social Impact, I have been given the charge to lead the stream of research on financial inclusion, resilience and wellbeing. CSI has a long-standing expertise in this space, and it was quite daunting to have to take over a project that most of my seniors, peers and juniors have helped nourish, evolve and blossom. Nonetheless, a research team and a workplace culture that exhibits collaborative partnerships and high-quality stakeholder engagement, has assisted me in evolving my thinking as well as put my slant on the understanding of the ‘wicked problem’ at hand.

In this blog post I would like to share my thinking on how the problem of financial hardship and vulnerability is framed in academic literature and how the experience pans out in practice. This exercise has been necessary (client request!) but also important in demonstrating how rhetoric and reality are often polls apart, nevertheless, possible to bring together. The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry report released earlier this year laid bare the problems in the plumbing of the financial services industry and provided some tools to fix it.

In mainstream academic literature, as well as in practice, the problems around financial difficulty are examined from an individual perspective. But as a sociologist by training, my knee jerk reaction is to first critically examine the structural and societal level drivers of financial distress. Clearly, there are some factors at the individual level contributing to the experience of financial hardship and vulnerability. For instance, lack of knowledge regarding how to manage money better, or not appropriately using the financial products in the marketplace, or perhaps leaving an abusive relationship that has resulted in bankruptcy. Nevertheless, when examining financial crisis, we are often focused on what the individual did wrong and how we can we ‘fix’ the issue. So perhaps, if they just had enough financial literacy, they would manage their money well, choose appropriate products and maybe even attend marriage counselling to fix that relationship.

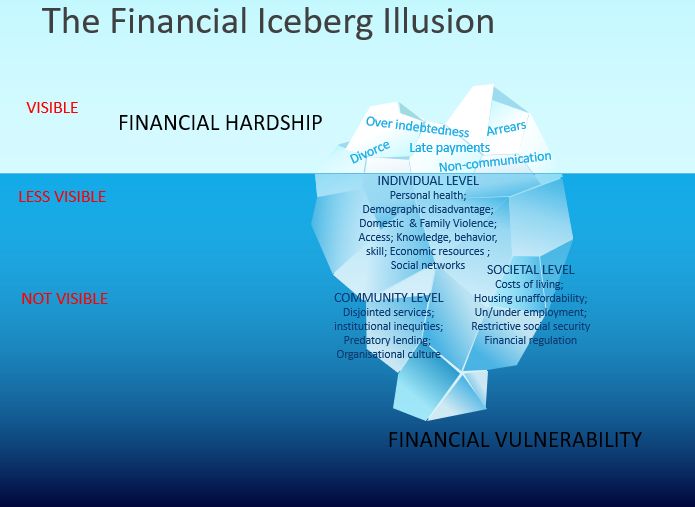

These have been popular strategies of intervention for decades with temporary and ad hoc positive (and negative) impact on the financial lives of the most vulnerable people in Australia. But what are the factors at the structural level having very real and detrimental consequences for the individuals? I present the Financial Iceberg, as a rhetorical tool to unpack factors at play at the individual, community and societal level, impacting everyday interactions with finance. Britannica encyclopedia tells me that what we can see at the surface level of an iceberg is only 10% of its structure, the remaining 90 % is invisible, hidden under very harsh conditions. This is akin to what is happening in the lives of vulnerable people. When we see them at the point of financial crisis, it is only a minimal part of their human story. The most prominent surface level triggers exhibiting financial hardship are over indebtedness, late payments of bills, arrears backing up to months, non-response to communications from creditors, relationship breakdown often leaving women and children homeless and penniless.

Often missing in the analysis of the situation is the question, what else is happening in the background? What are the harsh conditions in which their story of vulnerability is trapped? Could it be that their financial journey is barricaded by historical and ongoing systems of constraints because of the race or gender they belong to? Let us take the example of The Aboriginal and Torres Strait Island peoples who form 3% of the population of Australia but are over represented in statistics relating to financial marketplace disengagement. In 2018 about 85% of Indigenous peoples did not have emergency savings (i.e. 3 months) and were at high risk of accessing predatory and unregulated high cost credit (Weier et al. 2019). A nuanced analysis of what wealth or what being rich means for Indigenous populace of Australia found no connection with owning a home or having a high income. Rather it was implicitly represented as not having money troubles or not worrying about money but also being able to provide for family and community (Weier et al, 2019). Clearly, the money story is a new one in the lives of Indigenous peoples of Australia and therefore, understanding that vulnerability, emanating from historical and structural inequities that are beyond the control of the individual person is necessary to shift the financial trajectory towards financial resilience and wellbeing.

Just like tracking icebergs under water using radars (electromagnetic waves) and sonars (sound waves) provides insight into size, structure and direction of movement, it is necessary to track how the financial lives of certain groups are being systematically entrenched into poverty. For instance, Women and Bankruptcy (O’Brien, Ramsay & Ali 2019); Older Australians and Inheritance Impatience; and low-income earners and constrained social safety nets.

Since producing knowledge for knowledge sake is not the best use of knowledge, I’ll be talking all things Icebergs and Resilience at the 2019 Financial Inclusion forum alongside key notes by:

· Jenni Beetson-Mortimer - Northern Rivers Community Gateway

· Phil Usher – First Nations Foundation

· Rebecca Pinkstone – Bridge Housing

· Joanna Quilty – NCOSS

· Elizabeth Anderson – NAB

· Andrea Comastri – Payce Foundation

· Margot Politis – Milk Crate Theatre

· Louise Campbell - Social Ventures Australia

· Caroline Stewart - Ecstra foundation

We are at a moment in time in Australia where the public sentiment, government policy and business interests are seeking to embed ideas of trust, fairness, dignity and empowerment into the financial eco system of Australia. And I’m here for it!

Illustration taken from Indigenous Financial Resilience Report 2019. Designed by Indigenous owned creative business : WeAre27